Appraisal Month FAQ

In 2016 we introduced an ‘appraisal month’ based method of appraisal scheduling. Each doctor is expected to undertake an appraisal in every appraisal year (1 April to 31 March). Their due date for that appraisal year will be the last day of their allocated appraisal month. Should a doctor have an appraisal later than their appraisal due date (whether or not by agreement with their responsible officer), their next appraisal should revert to their original appraisal month.

For the majority of doctors on SARD their appraisal due date is straightforward. However, in certain cases, their due date can appear to be incorrect. Examples are:

- When their appraisal has been done late, so falls into the next appraisal year

- When their appraisal has been done early, so falls into the previous appraisal year

- When they are a new starter and they start after their appraisal month for the current appraisal year

We will discuss what to do in these situations and how they can be avoided.

Calculating the appraisal due date

First some information on how the appraisal due date is calculated on SARD.

- By default, a doctor’s due date will be the last day of their allocated appraisal month for every appraisal year. For example, if their appraisal month is January, their due date will be 31 January every year. For the 16/17 appraisal year it will be 31 Jan 2017. For the 17/18 appraisal year it will be 31 Jan 2018.

- If the doctor has a completed appraisal, their due date will be in their appraisal month of the following appraisal year. For example, if they completed an appraisal in the 16/17 appraisal year, their due date will be 31 Jan 2018.

- If the doctor is exempt for an appraisal year, their due date will be in their appraisal month of the following appraisal year. For example if they are exempt for the 16/17 appraisal year, their due date will be 31 Jan 2018.

- If the doctor has an extension, their due date will be the extension due date. For example if they are due on 31 Jan 2017, but have been granted a 2 month postponement, they will be due on 31 March 2018.

- If the doctor has no complete appraisals, exemptions or extensions but does have a start date, their due date will be in the appraisal month of the appraisal year in which they started. For example if they started in Dec 2017, their due date would be 31 Jan 2018.

- If the doctor has no complete appraisals, exemptions, extensions or start date, then their due date will be in their next appraisal month. N.B. This is not a good position to be in as the due date will always be in their upcoming appraisal month. Any doctor in this situation will have compliance unknown, so they are easy to find on the Admin, Appraisals, Appraisal Compliance page.

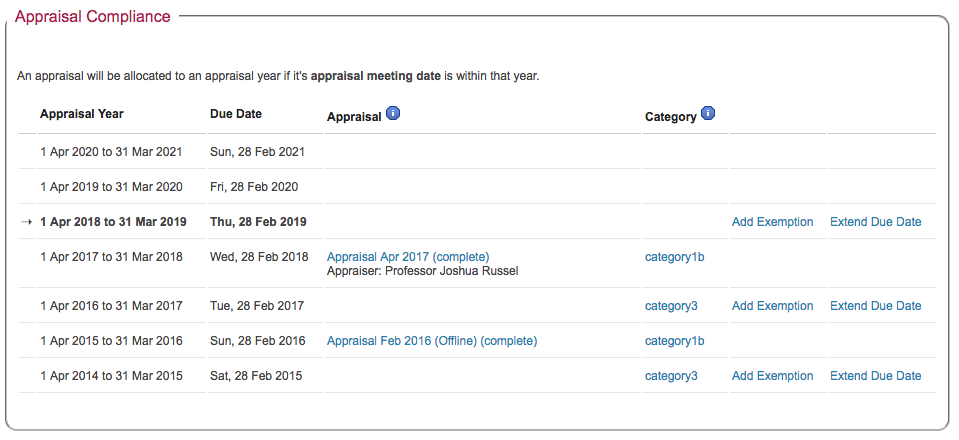

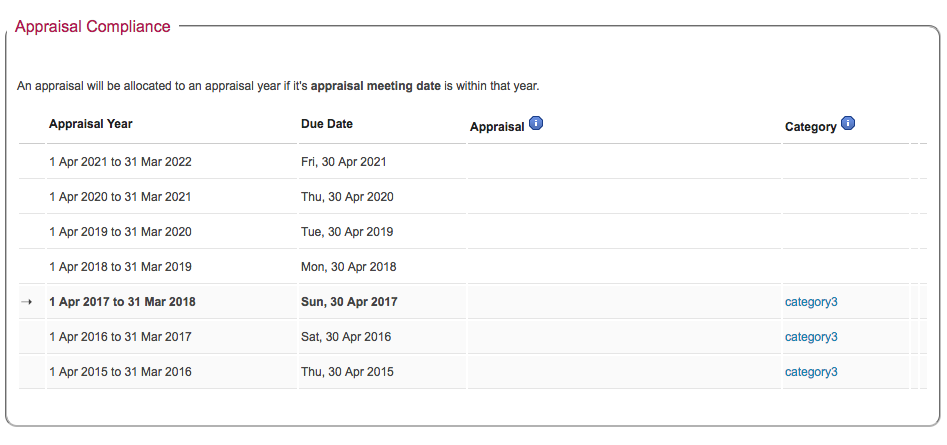

What to do when the due date is a year ahead of where it should be.

An appraisal has been completed LATE and falls in to the next appraisal year (and so the due date is a year ahead of where it should be). To ‘pull back’ the appraisal due date, extend the due date to the date of the appraisal.

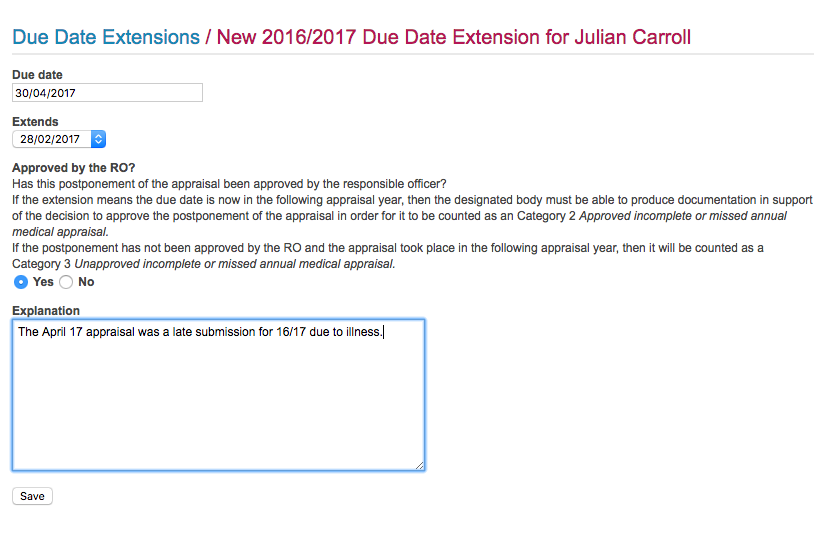

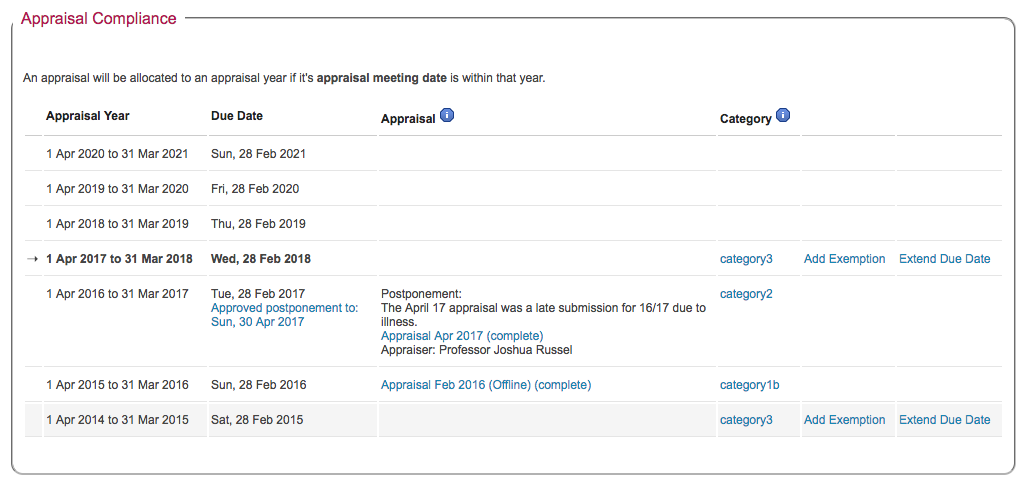

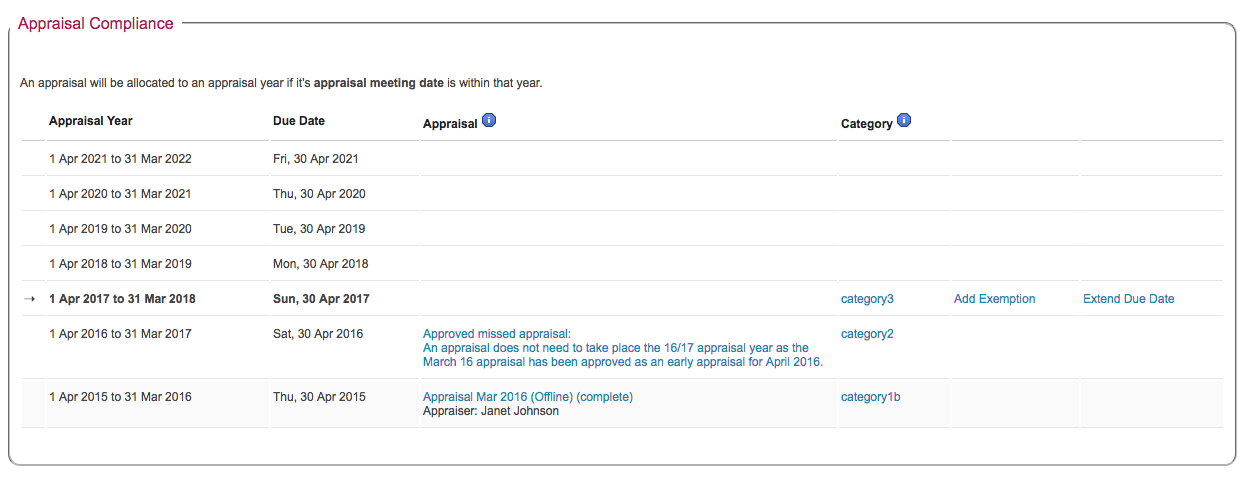

For example: Dr Carroll’s appraisal month is February. For the 16/17 appraisal year he was due on 28 February 2017. The late appraisal actually took place on 30 April 17 i.e. in the 17/18 appraisal year. His due date is currently 28 February 2019, but it should be 28 February 2018.

To ‘pull back’ the appraisal into the 16/17 appraisal year, click on ‘Extend Due Date’ in the 16/17 appraisal year row and extend the 28 February 2017 due date to 30 April 17.

Dr Carroll now has a due date of 28 February 2018.

To reduce the number of doctors that have a late appraisal that takes place in the following appraisal year, we recommend the number of doctors with an appraisal month of March are kept to a minimum.

Bespoke appraisal reminders can be setup to encourage doctors to complete their appraisals on time.

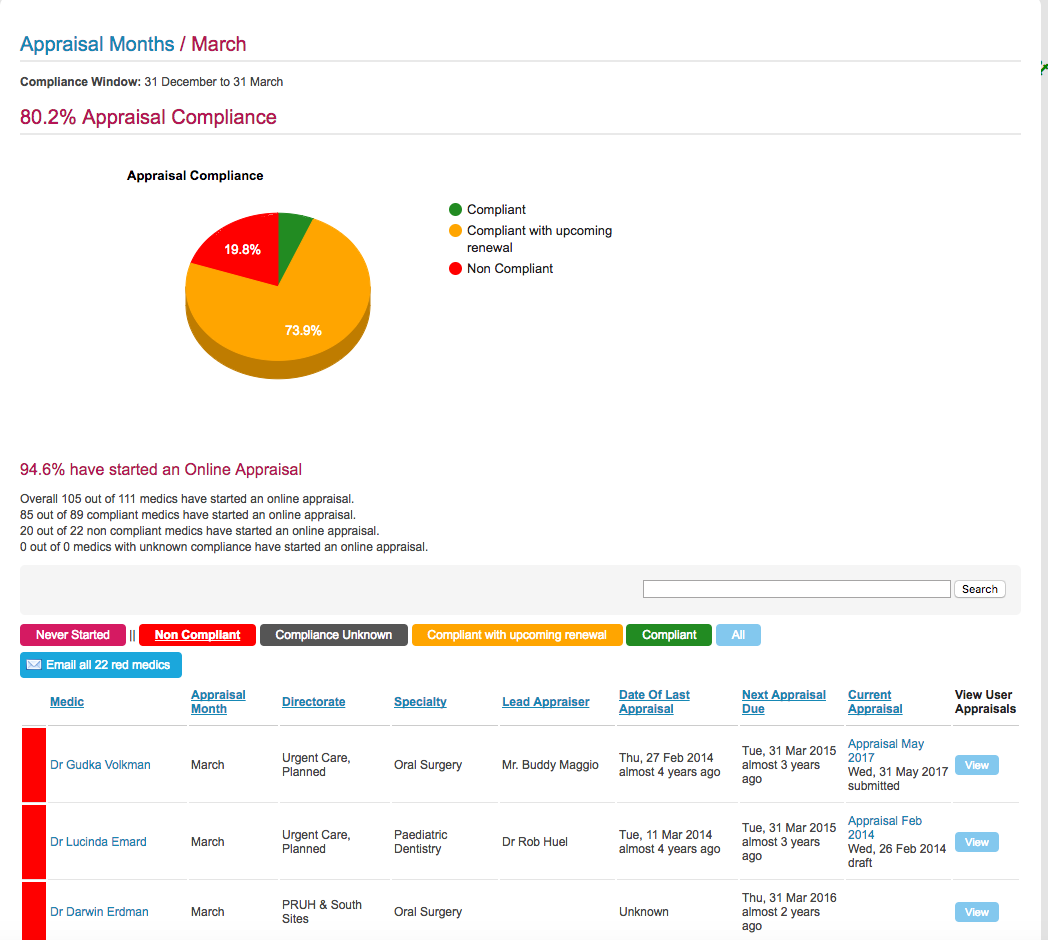

It’s also worth keeping a closer eye on doctors that do have a March appraisal month. The Admin, Appraisals, Appraisal Months page can be useful for this. From this page you can click on any month and get compliance data for doctors that have that appraisal month.

What to do when the due date is a year behind where it should be

An appraisal has been completed EARLY and falls in to the previous appraisal year (and so the due date is a year behind where it should be). To ‘push forward’ the appraisal due date, add an exemption.

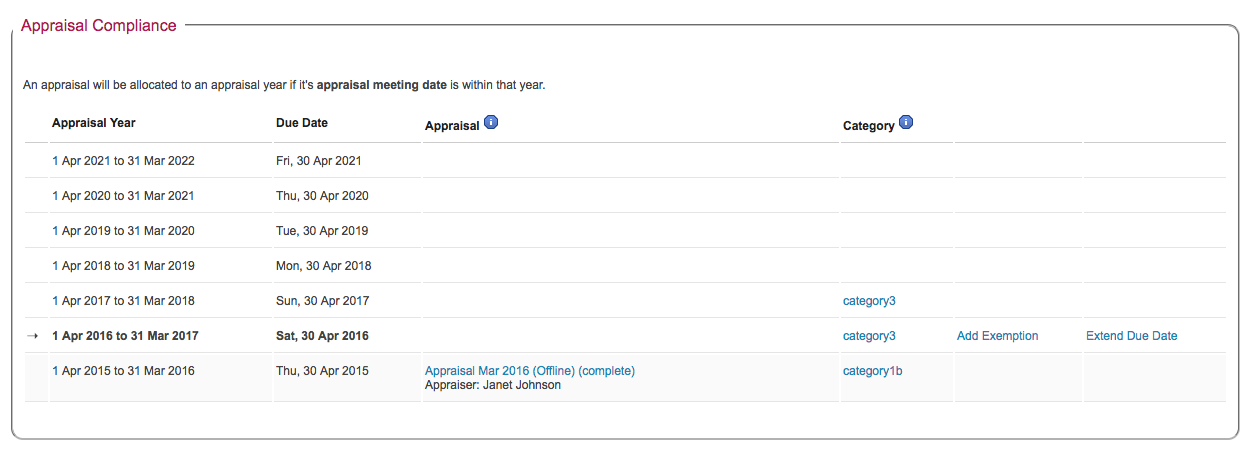

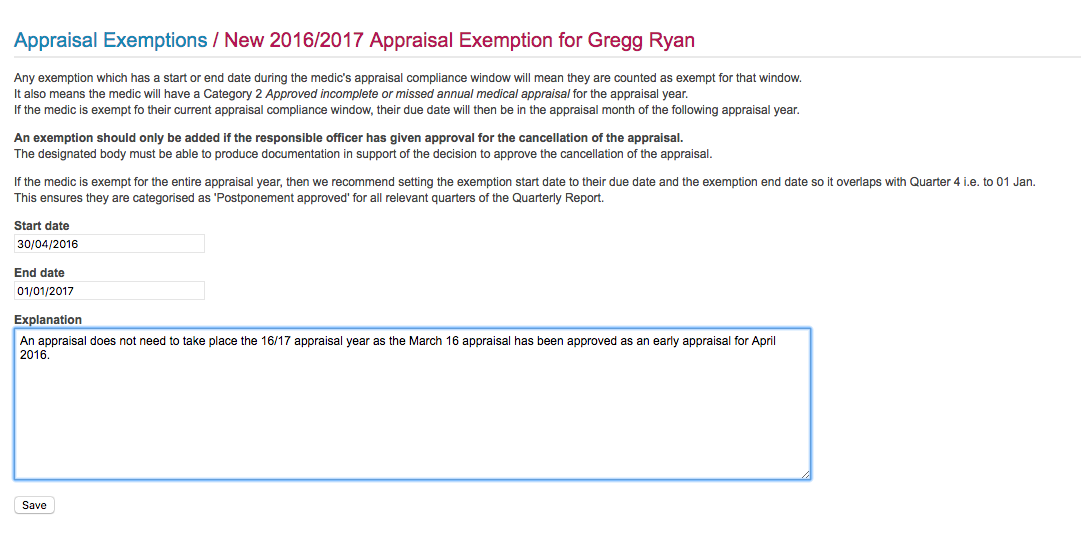

For example: Dr Ryan’s appraisal month is April. For the 16/17 appraisal year he was due on 30 April 2016. The early appraisal took place on 30 March 2016 i.e. in the 15/16 appraisal year. His due date was initially 30 April 2016.

We are following the NHS England Guidelines set out here:

NHS England Annex C – Annual Organisational Audit (AOA)

when it comes to allocating appraisals to appraisal years. Unfortunately they don’t allow for an early appraisal to be allocated to the next appraisal year. In this case, click on ‘Add Exemption’ in the 16/17 appraisal year row.

His due date will now be 30 April 2017. N.B. the category for the 16/17 appraisal year will be a category 2 (approved missed or postponed appraisal).

To reduce the number of doctors that have an early appraisal, we recommend the number of doctors with an appraisal month of April is kept to a minimum. Also, each trust can set the content for the bespoke appraisal reminders so they can specify that appraisals should take place within their allocated appraisal month and not before.

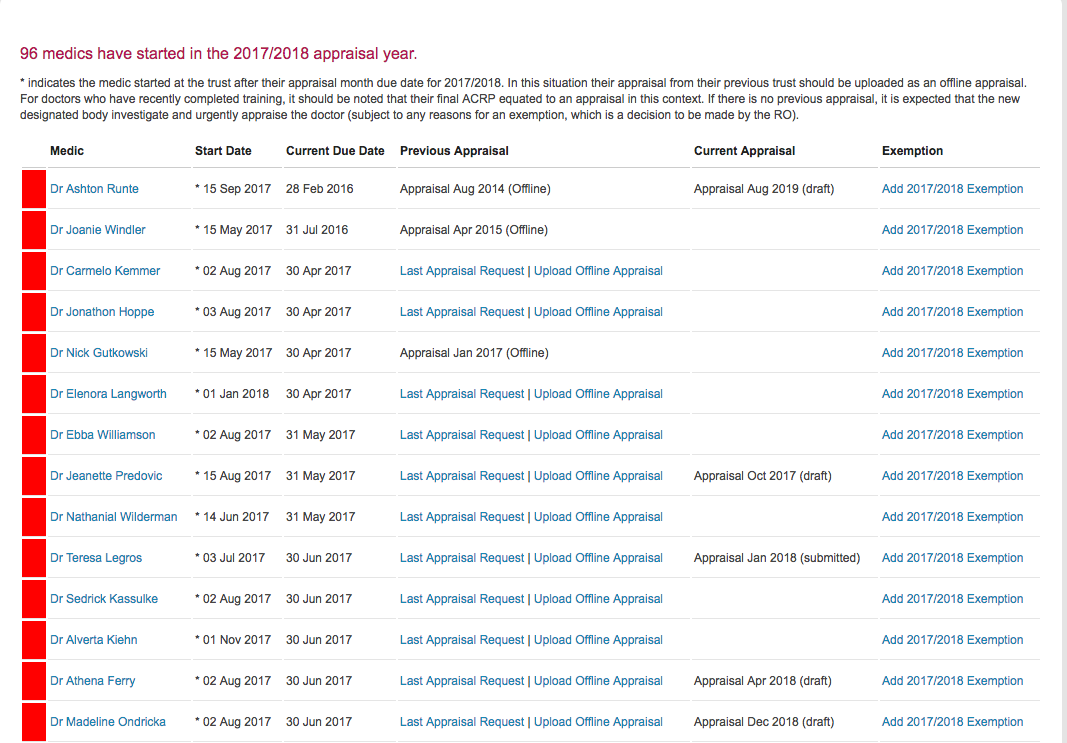

What to do when a doctor starts after their appraisal month due date.

For example, Dr Langworth started in January 2018, in the 17/18 Appraisal Year. Her appraisal month is April, so her due date for that year is 30 April 2017 and she is currently non compliant. In this situation her appraisal from her previous trust should be uploaded as an offline appraisal. For doctors who have recently completed training, it should be noted that their final ARCP equates to an appraisal in this context. If there is no previous appraisal, it is expected that the new designated body investigate and urgently appraise the doctor (subject to any reasons for an exemption, which is a decision to be made by the RO).

To manage new starters there is an Admin, Appraisals, New Starters page which lists doctors that started in the current appraisal year. On this page there are links to request details of a doctor’s previous appraisal, upload a previous appraisal or add an exemption.

N.B. Dummy data was used in all of the above images.

If you have any questions or feedback on the above, please get in touch via 0208 771 4153, info@sardjv.co.uk or the live chat button below.